52+ when do mortgage companies report to credit bureaus

A home equity line of credit that is added to your mortgage may be. Web The credit bureaus decides if they use this information when they determine your credit score.

When Will Your New Mortgage Show On Your Credit Report

But smaller regional banks and credit unions may only report to one or two credit bureaus.

.jpg)

. Web Banks credit unions retail credit card issuers auto lenders mortgage lenders debt collectors and others voluntarily send information to credit reporting. Web In general most major banks report to all three credit bureaus. Web For example if you have a Chase credit card Chase can only report about your activity with that particular credit card.

Web Lenders including mortgage companies are not required to report account information to the national credit reporting companies. As such you can start seeing the negative. If your report lists low account balances and no.

The Fair Credit Reporting Act FCRA governs. Web Equifax TransUnion and Experian are the three main credit bureaus in the US. Ad Change Happens Fast.

Web Each month your mortgage payment if reported is reported as paid on time or late if the lender receives it 30 days or more past the due date. Nows the Time to Check In On Your Credit with TransUnion. Get Your Score Powerful Tools.

Web Studying your credit reports will give you a better idea of what types of mortgages you might qualify for. Web Lenders report delinquencies monthly and credit bureaus follow suit by adjusting your scores immediately afterward. Web Self-reporting is a process that involves a third-party service that will report your payments to all three credit bureaus.

Ad Compare the Top Mortgage Lenders Find What Suits You the Best. Special Offers Just a Click Away. Choose Smart Apply Easily.

In fact creditors and lenders including. Nows the Time to Get Powerful Score Planning Report Protection. Web How To Report Your Rent Payments To Credit Bureaus Well timed funds are an important issue of your credit score rating accounting for a full 35 of your.

Credit bureaus automatically gather. Web Add to that the fact that credit card issuers generally report every 30 to 45 days but there arent set guidelines and each creditor can choose when to report and. They are the three largest nationwide providers of consumer credit reports to.

In most cases if your.

Why Your Mortgage Isn T Showing Up On Your Credit Report

.jpg)

14 Oracle Financial Services Lending And Leasing Reports

Free Georgia Real Estate Practice Exam Questions March 2023 52

Free 10 Business Loan Contract Samples In Ms Word Google Docs Pdf

The Residential Mortgage Credit Report What You Need To Know Credit Karma

How Many Credit Checks Before Closing On A Home Big Valley Mortgage

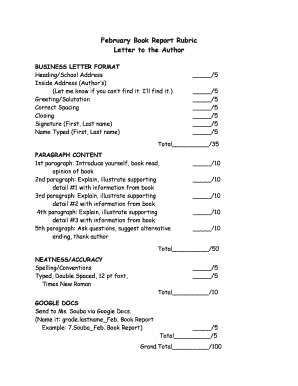

52 Free Editable Report Letter Templates In Ms Word Doc Page 4 Pdffiller

I6hszgawxbjdtm

A Guide To Ondeck Business Credit Reporting Ondeck

Everything To Know About The 3 Credit Bureaus Fiscal Tiger

Free 6 Sample Credit Inquiry Forms In Ms Word Pdf

How To Report Payment History To Credit Bureaus Experian

Mortgage Grace Periods Late Mortgage Payments Moneytips

Can I Get My Mortgage Payments Reported To My Credit Report

Credit Reporting Screen

Equifax Dispute Lowered My Credit Score 72 Points

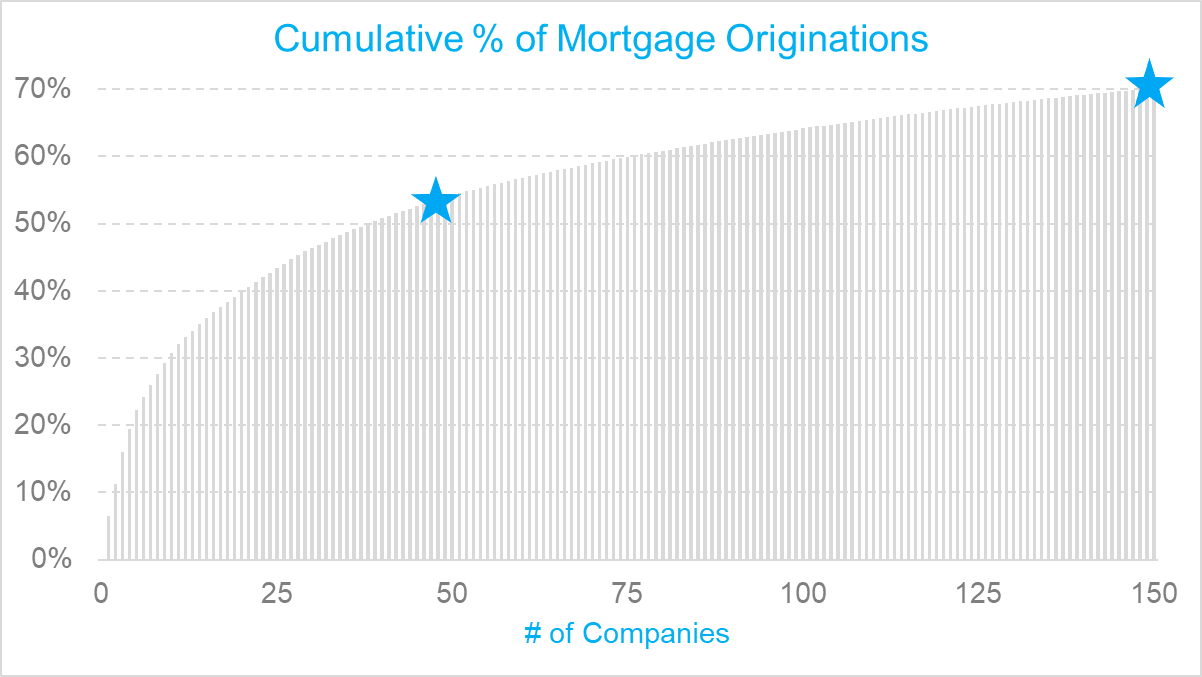

The Top 150 Mortgage Lenders In 2019 Bundle